Where All the Money Went in 2025?

AI now attracts roughly half of venture capital. That boosts innovation but starves other sectors and raises market correction risk.

Why it matters

For the first time, AI companies are absorbing around half of all global venture capital. That’s great for AI innovation, but it starves other sectors of cash and raises the chance of a painful correction if expectations run ahead of results.

The big shift

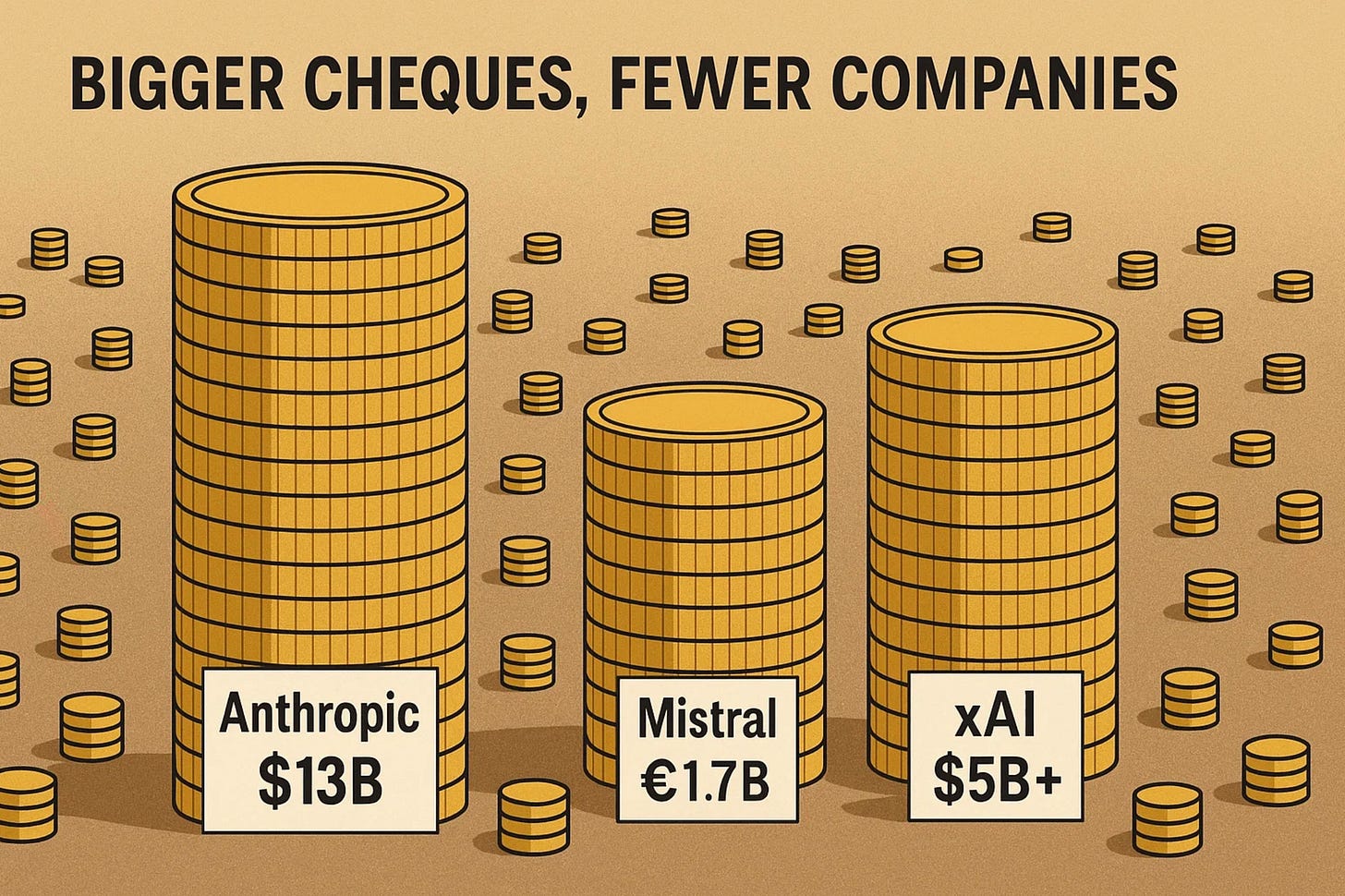

Across 2025, trackers show AI taking a majority share (or close to it) of venture funding, an historic reallocation of capital. Q3 data from multiple sources points to a market where larger cheques are going to fewer companies, especially AI leaders.

Mega-rounds set the tone: Anthropic’s $13bn raise at a $183bn valuation, ASML’s €1.3bn into Mistral (€11.7bn valuation), and xAI’s multibillion financing dominated headlines and totals.

Fewer deals, more money: CB Insights reported AI deal counts down ~22% QoQ in Q3 while AI funding still stayed north of $45bn for the fourth straight quarter, classic concentration.

What this means for everyone else

When more than half of the venture firehose points at one field, other sectors feel it.

Harder fundraising: Non-AI startups face longer cycles and tougher terms. Investors are prioritising AI or demanding an “AI angle” before backing anything else.

Talent gravity: Engineers, data scientists and PMs follow the money, pushing up wages in AI roles and slowing product roadmaps elsewhere. (Inference grounded in the funding concentration patterns above.)

Second-order effects: “AI-adjacent” suppliers (chips, data centres, power) benefit even if they’re not selling AI software.

Reality check: the first proper wobble

The week ending 7 November 2025 delivered a sharp reminder that concentration cuts both ways: about $800bn was wiped from big AI-linked tech names, and the Nasdaq fell ~3% for the week, its worst since April. Markets questioned sky-high AI valuations and capex intensity.

Could this be a bubble?

Maybe. Signs to watch in plain English:

Big prices, thin breadth: Deal counts falling while cheques get bigger, “money chasing fewer names”.

Single-name dependence: If one or two giants drive a big chunk of each quarter’s totals, any stumble can drag the whole narrative.

Real-world constraints: AI needs chips, data centres and power. If supply tightens or costs bite, growth slows and multiples compress.

On the other hand, AI isn’t just a fad; it’s a platform spreading into healthcare, finance, industry and the public sector. If productivity gains persist and costs per task keep dropping, today’s investment could be justified.

Practical takeaways (non-AI teams, this is for you)

Don’t “AI-wash”. Rebranding without capability backfires.

Show the link to value. If AI reduces cycle time or cost-to-serve, prove it with simple metrics.

Stay capital-efficient. Smaller milestones and faster paybacks cut funding risk in a selective market.

For a deeper insight and analysis on this story,

Join the Member’s Club!

Disclaimer: This article represents analysis based on publicly available data as of November 2025.