The Microsoft–OpenAI reset

What the new pact really means for the future of both companies

Why it matters

Microsoft and OpenAI have signed a new long-term deal that shapes how both companies build and sell advanced AI. Microsoft keeps access to OpenAI’s tech until 2032, OpenAI agrees to spend $250bn on Microsoft’s cloud (Azure) over time, and an independent panel will confirm any future claim that OpenAI has reached AGI. It’s a reset, not a breakup—both sides get more room to move.

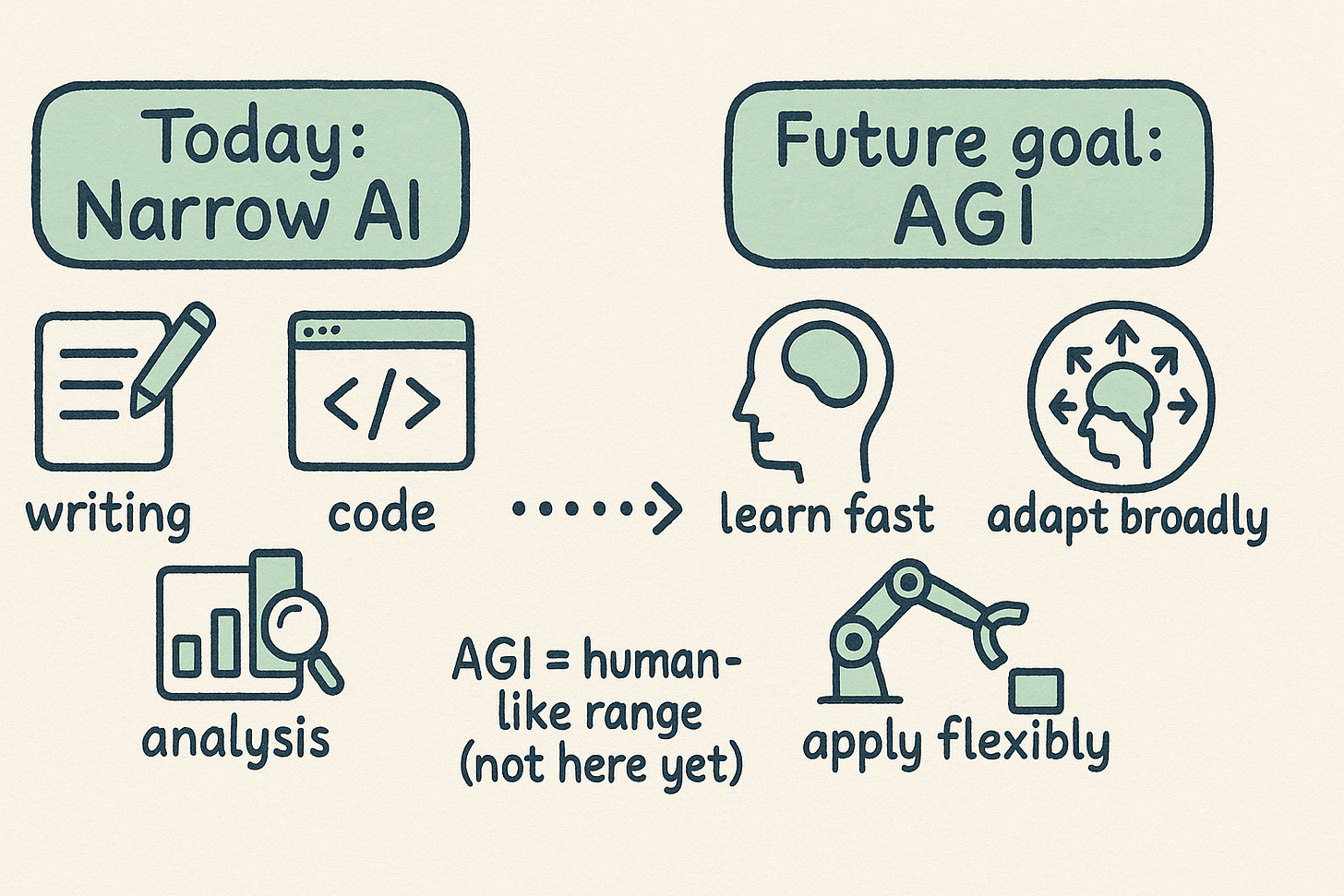

Quick explainer: What is AGI?

Artificial General Intelligence (AGI) is the idea of an AI that can handle most mental tasks a human can—learn new things fast, adapt to new problems, and use knowledge flexibly.

Today’s AIs are strong but narrow: great at writing, coding, and analysis, yet not “all-rounders”. AGI doesn’t exist yet—it’s a research goal.

You may see “general-purpose AI (GPAI)” in policy papers; that refers to today’s versatile models, not human-level intelligence.

AGI matters here because some contract terms (like exclusivity and IP rights) change only if AGI is independently verified—hence the new outside panel.

What actually changed

New structure and stake. OpenAI is creating a Public Benefit Corporation (PBC) under its nonprofit. Microsoft would hold about 27% of this PBC on a diluted basis, implying a stake worth around $135bn after the recapitalisation.

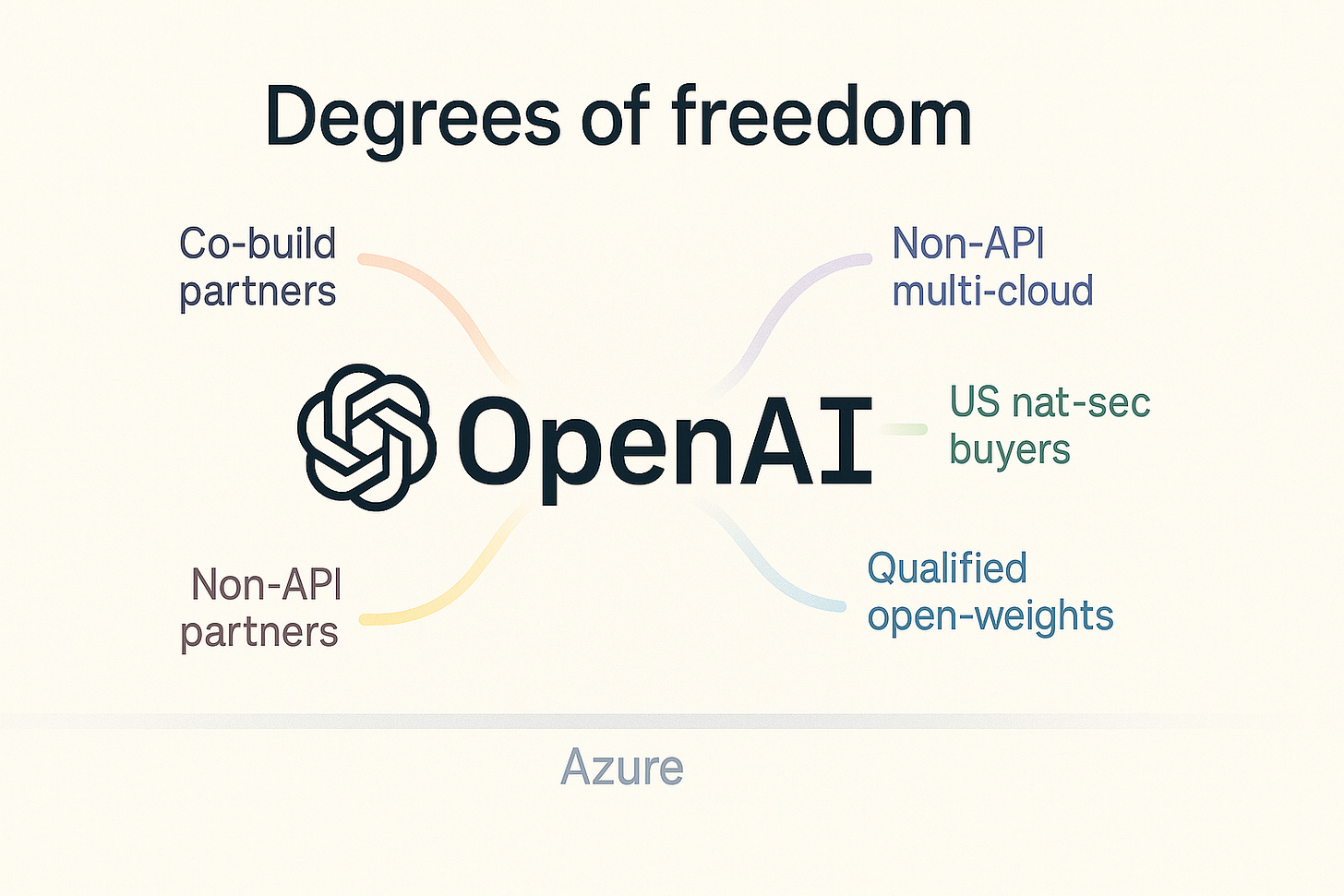

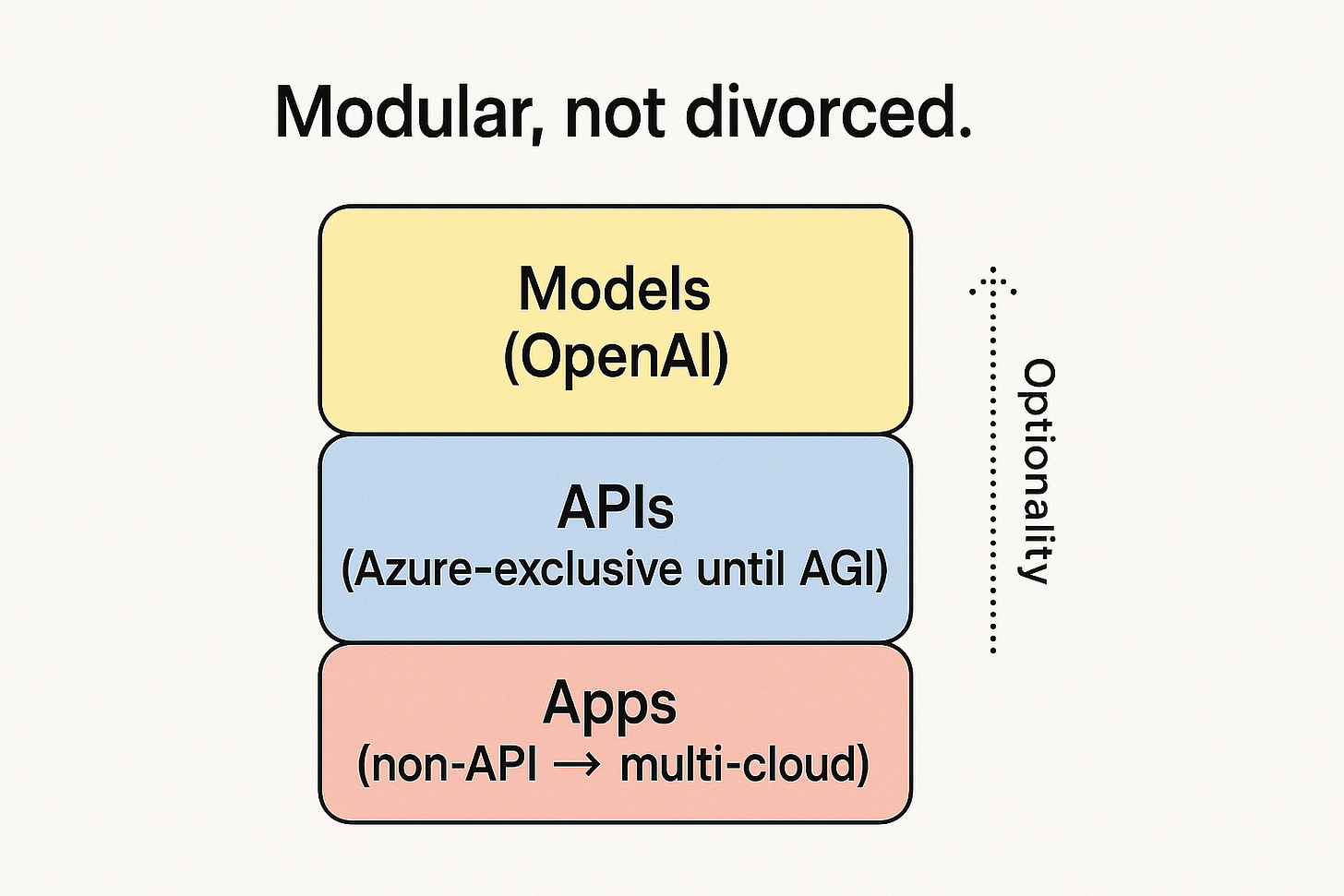

Where things run. OpenAI stays Microsoft’s top partner for frontier models. Its developer tools (APIs) remain Azure-only until AGI, but other products can run on any cloud.

How long Microsoft can use the tech. Microsoft’s rights to use OpenAI models and products run to 2032, including future, more capable models (with safety limits). OpenAI’s research know-how is shared confidentially to 2030 or until AGI is verified. Consumer hardware is not covered by Microsoft’s rights.

Who calls “AGI”. Any claim of AGI must be checked by an independent expert panel.

Cloud and cash. OpenAI signs up for an extra $250bn of Azure. Microsoft gives up first dibs on OpenAI’s future compute purchases.

OpenAI’s new freedoms. It can co-build products with others (APIs still Azure-only), run non-API products on any cloud, sell to US national-security customers on any cloud, and release certain open-weight models under conditions.

Microsoft’s freedom. Microsoft can pursue AGI on its own or with other partners.

Market reaction

Investors welcomed the clarity: Microsoft’s share price ticked up on the news, helped by the long runway for Copilot-style products and the huge Azure commitment.

What it means for Microsoft

1) A huge, predictable cloud customer.

That $250bn Azure commitment is long-term demand you can plan around. It supports more data centres and custom chips, and strengthens Microsoft’s hand when pricing AI infrastructure. Microsoft loses “first right” on future OpenAI compute, but the guaranteed Azure usage is the headline.

2) Product stability to 2032.

Microsoft keeps the right to use OpenAI’s models through 2032, even for stronger, post-AGI models (with guardrails). That lowers the risk that Copilot, Fabric and other products get stranded by contract quirks. The independent AGI panel also reduces any “who decides?” drama.

3) More hedging power.

Microsoft can now push its own AGI path alongside OpenAI. That fits with its smaller models (like Phi) and other partnerships, and keeps leverage into the 2030s.

4) Fewer antitrust headaches.

Regulators in the UK said the earlier setup wasn’t a merger. This new deal loosens some exclusivity and adds governance, which should look better to competition authorities.

Bottom line for Microsoft: More time, more options, more cloud usage—in exchange for giving OpenAI more freedom.

What it means for OpenAI

1) Control with capital options.

Moving to a PBC gives OpenAI a fund-raising route (even an eventual IPO path) while the nonprofit stays in control. That’s mission-first, with serious financial firepower.

2) More ways to reach customers.

OpenAI can now co-build with partners, run non-API products on any cloud, work with US national-security customers regardless of cloud, and publish qualified open-weight models. That widens revenue and developer reach.

3) Azure remains the main rail.

The $250bn Azure commitment keeps the heavy lifting on Microsoft’s cloud—likely with priority access to GPUs and joint tuning. Dropping Microsoft’s “first right” means OpenAI can still shop around when it helps on price, location, or classification needs.

4) Hardware is on the table.

Consumer hardware is outside Microsoft’s rights. Paired with OpenAI’s recent moves into desktop/agent experiences (for example, Sky), expect a clearer story for ChatGPT as an on-device operator over time.

Bottom line for OpenAI: More routes to market and policy reach, while keeping the Azure bridge intact.

The bigger picture: what this sets up

A referee for the “AGI moment”.

The independent panel is a template others may copy, so AGI declarations don’t blow up contracts and revenue splits.

A slightly looser stack.

APIs stay Azure-only until AGI, but apps, such as Sora, that aren’t APIs can run on any cloud. Expect more multi-cloud for speed, sovereignty and resilience.

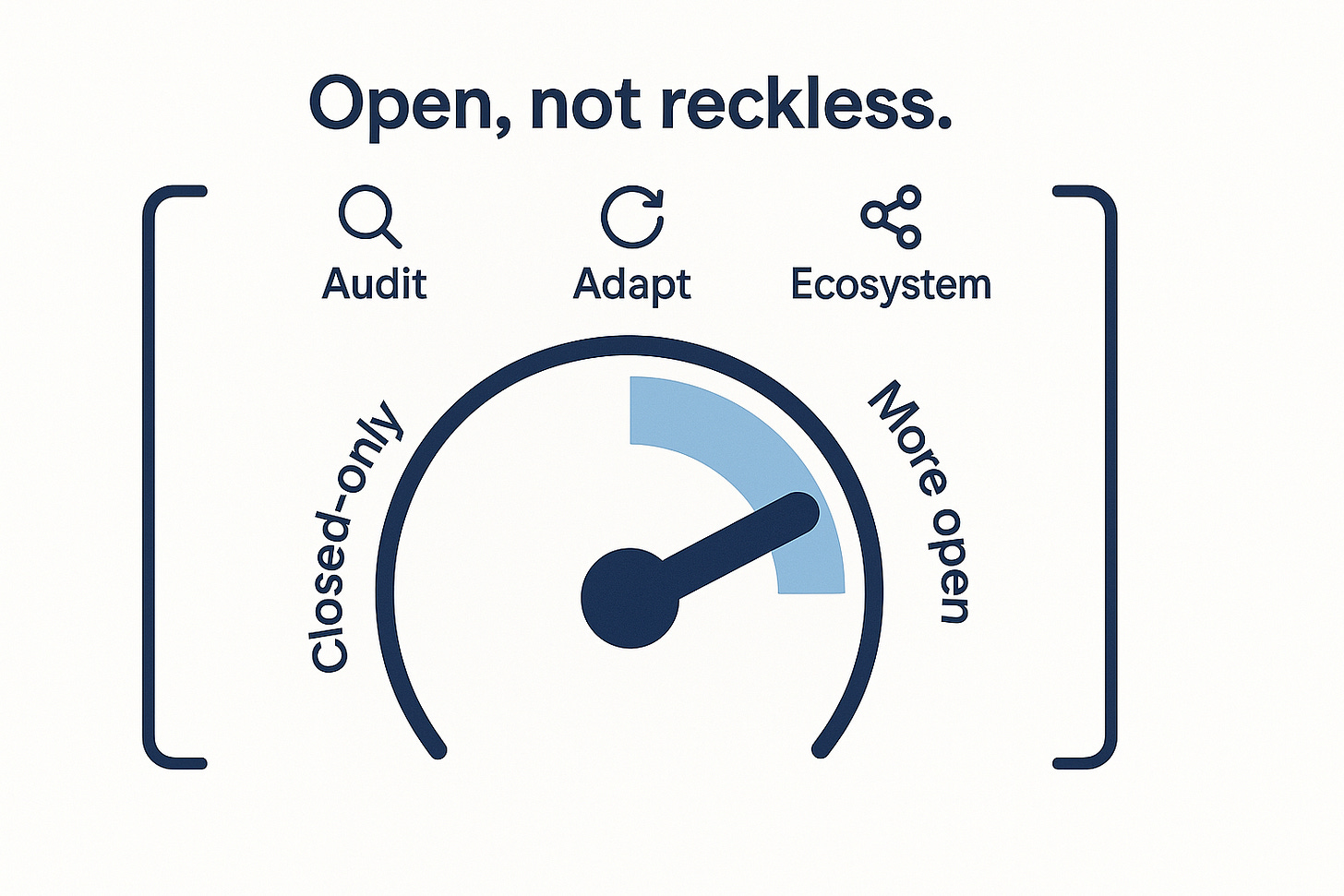

Open-weight models in the spotlight.

Allowing qualified open-weights pressures closed-only strategies and helps governments and regulated sectors that want more transparency.

Regulators will keep watching.

Don’t expect a free pass next time—authorities are studying AI partnerships closely. This redesign is meant to look less like lock-in.

New battles: hardware, interfaces, agents.

With hardware carved out and agentic desktop moves advancing, both firms will compete and integrate across Windows, Copilot and ChatGPT.

Risks to keep in mind

Chips and energy. Scaling to $250bn of cloud still depends on GPU supply, electricity and capital costs.

Governance details. The AGI panel only works if its criteria and membership are credible.

Competition concerns. If the deal still results in de-facto lock-in, regulators may push back.

Partner tension. Microsoft’s right to build its own AGI keeps pressure in the relationship.

Safety and liability. Using stronger, post-AGI models under “guardrails” raises legal and safety questions.

What to watch next

Who joins the AGI panel, and how AGI is defined in practice.

Which open-weight models OpenAI releases—and how capable they are.

US national-security contracts and which clouds they use.

OpenAI capital moves (secondary sales or IPO steps) under the PBC.

Microsoft’s data-centre spend and silicon plans tied to the Azure commitment.

Practical takeaways for leaders

Build a multi-cloud plan for AI; don’t assume one stack forever.

Design products for portability and agent-style user experiences.

Update contracts now for possible AGI triggers and open-weight licensing.

Treat AI infrastructure like energy hedging: anchor on Azure where it helps, but keep options open elsewhere.

“Not a divorce—structured independence. Close partners, with more room to manoeuvre.”